Trading isn’t that difficult.

Fill your room with monitors, stay glued to the screens,

stay updated with market news, and predict the market movements.

But there’s the point. Why Settle for Predictions when you can have Certainty?

While others are biting their nails, Quantl's real-time AI algorithm is busy learning and adapting. So that your trading isn't just data-informed— it's data-driven.

Transform faster with unparalleled observability, automation, and intelligence in one platform. A fully flexible and customizable solution that leverages an open architecture to integrate proprietary logic and third-party trade workflow component. A complete set of exposure and performance measures, smart orders and technical indicators to evolve with your business.

Design and test your strategy on our free data and when you're ready deploy it live to your brokerage. Code in multiple programming languages and harness our cluster of hundreds of servers to run your backtest to analyse your strategy in Equities, FX, Crypto, CFD, Options or Futures Markets.

Order Execution & Management

Whitebox solution providing advanced Order Execution & portfolio Management (OEMS) for all digital assets. Take full control of your spot and derivative assets held across your accounts and portfolios with accurate and timely decision support capabilities to maximize returns and alpha generation

Strategy & Trade Lifecycle

Design strategies from scratch using browser based IDE with multiple API Options (Rest, Websocket and FIX). Benefit from live collocated or solo trading environment. Execute on one of the 9 supported brokers, 20+ exchanges and high frequency data feeds. Trade Crypto, Equities, Commodities & FX systematically with ease. Get Real time notifications with Websocket API.

Order Execution & Management

(OEMS)

Use your preferred order type in any market and benefit from Quantl best execution capabilities and advanced API options.

- Support for virtual spot positions

- Supported order types: market, limit, stop, stop limit, trailing, bracket

- Multiple time-in-force options: day, good-till-cancel, good-till-day, immediate-or-cancel, fill-or-kill, at-the-open, at-the-close

- Support for spot and margin trading

- Custom order properties to add custom information to your outgoing orders, e.g., venue-specific fields or algorithm-related properties

- Custom pre-trade checks, e.g. Maximum trade value, Maximum position value, Maximum order quantity, asset type white-/blacklisting or order type white-/blacklisting

- Multi-account functionality with support for sub-accounts, managed accounts and fund accounts including:

- Venues that support multiple sub-accounts (using the same API keys for all sub-accounts)

- Venues that do not support sub-accounts (using different API keys for multiple accounts)

Execution algos and Smart Order Routing (SOR)

The Quantl infrastructure offers a wide range of best execution capabilities to execute large orders with minimal price impact.

- Built-in Smart Order Routing (SOR) execution algorithms which allow to gain better execution prices and minimize market visibility and impact

- VWAP (Volume-Weighted Average Price)

- TWAP (Time-Weighted Average Price)

- POV (Percent of Volume)

- Iceberg

- Sniper

- Market Sweep

- Smart Market, Limit, Stop and Stop Limit

- Trailing Limit

- Target Position

- Broker-side execution algorithms (VWAP, TWAP, Percent of Volume, Accumulate/Distribute)

- Full support for OTC and RFQ processes, whereby requesting committed quotes from multiple brokers and OTC desks

- Algo order parent/child display

Brokers

MENA's first alpha

marketplace

Easily deploy your strategies to Quantl's collocated live trading environment. We handle everything so you can focus on your strategy development. Design and test your strategy on our free data and when you're ready deploy it live to your brokerage. Code in multiple programming languages and harness our cluster of hundreds of servers to run your backtest to analyze your strategy in Equities, FX, Crypto, CFD, Options or Futures Markets.

Harness the power of

Machine Learning in your next strategy

Create your application in any language. No more C++/Java limitations. Use the technology you already know, and spend your time creating, not integrating.

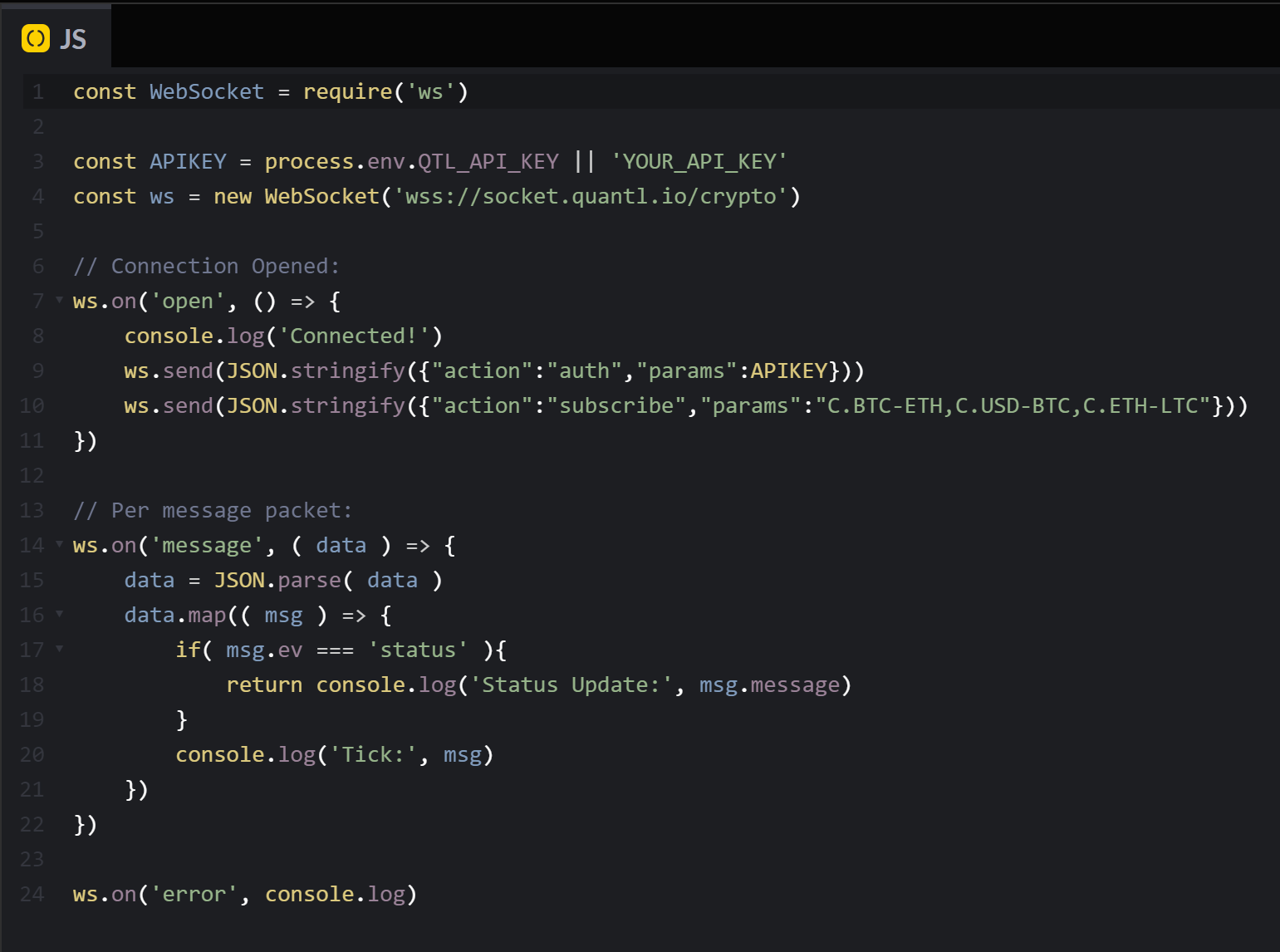

We provide you structured, versioned JSON RESTful and Websocket APIs with low latency and more than 20+ year of historical data.

Our APIs RESTful API is enriched with Machine Learning variables, Optimization parameters and advanced statistical parameters to enhance your alpha production.

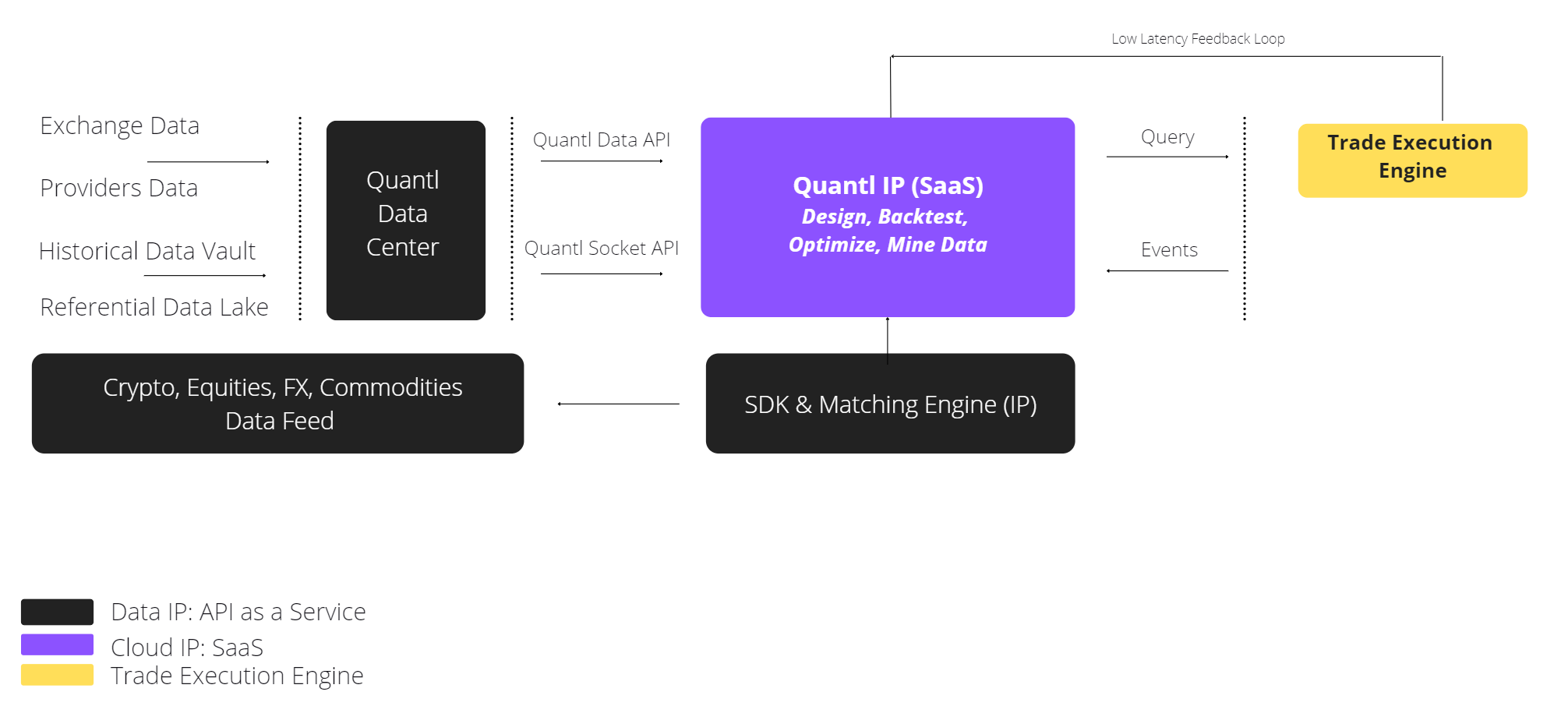

Quantl API

Multiple API options offer the integration into your existing system landscape using standard technology.

- Inbound FIX API supporting simple orders, execution algos and market data

- Machine Learning 4 trading (ML4T) API to provide sophisticated mathematical models via REST interface

- Inbound REST interface to access all features of the platform

- Real-time event notifications via WebSocket API

- API Management wallet, to store keys to be used with ML4T Rest, Websocket or FIX APIs.

Code Algorithms In A Browser Based IDE, with Terabytes of Free Financial Data

Build, Backtest and Deploy your quant strategies from scratch and benefit from unlimited flexibility.

- Strategy Wizard creates everything needed for Quantl-based quant trading strategies

- IntelliJ-(or AWS Cloud9) Based Development Environment

- Excel based backtest report to analyse strategy performances

- In-Process / In-Memory Exchange Simulator

- Make use of all Quantl services from Java or Python strategies

- Write trading strategies in any language (e.g. C#, Javascript/Node.js, MatLab or R) using our RESTful and websocket

- A customizable and extensible Execution Model for backtests, which allows users to add custom logic regarding spread, slippage, fill ratio and more

- Automated parameter optimization to help find optimal parameter ranges for particular trading strategies

- Multiple Numerical and Statistical Libraries with a large number of technical indicators available

- Subscribe to a multitude of event types disseminated by the platform (e.g., TickEvents, BarEvents, OrderStatusEvents, FillEvents, SessionEvents, etc.)

- JSON based properties on most entities

- Multi-periodicity strategies (e.g. daily bars and minute bars combined)

- Multi-module strategies communicating with each other via Generic Events

- Start and stop strategies individually, allowing you to update & deploy strategies while others are running

- Debug strategies to perform diagnostics by going through strategies step by step

Secure Development Environment

Quantl gives you everything you need to build deep integrations without the risk. Our platform adheres to SOC 2, GDPR, CCPA, HIPAA | HITECH, and FINRA regulations and undergoes rigorous external audits and penetration tests.

Data Residency

Choose from data centers across the United States, Canada, and the European Union.

Encryption and Access Control

All Quantl API calls require proprietary OAuth2 authentication tokens only granted by Quantl. User data is encrypted at rest using enterprise-grade standards.