The world of foreign exchange, or forex, trading has evolved drastically over the years. With technological advancements and increased market efficiency, traditional manual trading strategies have made way for faster, data-driven, and automated trading methods. Enter algorithmic trading—a system that relies on advanced computer algorithms to trade currencies with precision, speed, and objectivity.

In this blog, we will walk you through the basics of forex algorithmic trading, its workings, and how it can be a game changer for traders at all levels.

What is Forex Algorithmic Trading?

Algorithmic trading, also known as algo trading or automated trading, involves using pre-programmed trading instructions to execute orders on the forex market. These instructions can be based on various variables such as timing, price, and volume. Essentially, algorithmic trading removes the emotional and psychological aspect of trading by automating the decision-making process using data and market signals.

In forex trading, algorithms are designed to trade currencies like the U.S. dollar (USD), Euro (EUR), British pound (GBP), and others based on specific market conditions. The goal is to take advantage of price differences, arbitrage opportunities, or trends with minimal human intervention.

One of the key advantages of forex algorithmic trading is that it allows traders to execute large volumes of trades rapidly, often in milliseconds, which is impossible with manual trading. This speed and efficiency are particularly valuable in a highly liquid and volatile market like forex, where timing is everything.

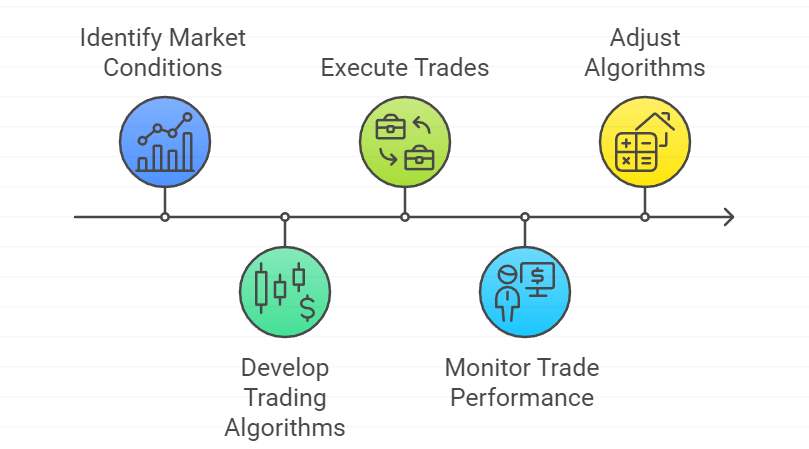

How Does Forex Algorithmic Trading Work?

At the core of forex algorithmic trading is a set of rules or an algorithm that guides a computer to execute buy and sell orders on a currency pair. But how does this actually work?

Defining a Strategy

Every algorithm starts with a trading strategy. Strategies can be as simple as following moving averages or as complex as using artificial intelligence to predict market behavior. Traders or developers write the algorithm based on their chosen strategy, dictating how the system should respond to various market conditions. For example, a trader may program the algorithm to buy EUR/USD if its 50-day moving average crosses above its 200-day moving average, and to sell when the opposite happens.

Data Collection and Analysis

Once the algorithm is live, it continuously monitors the forex market. It collects and processes real-time data, such as price movements, market sentiment, and technical indicators. In many cases, algorithms use historical data to backtest strategies before being implemented in live markets, ensuring the strategy is sound.

Order Execution

After analyzing the data, the algorithm determines whether to execute a buy or sell order based on pre-set conditions. It sends these orders directly to the market without human intervention. This process can be repeated hundreds or thousands of times per day, depending on the strategy.

Risk Management

Risk management is a crucial aspect of any forex algorithmic trading system. Most algorithms are designed with risk controls that limit the size of trades, set stop-loss levels, or adjust the strategy when market conditions become too volatile. By incorporating risk management techniques, traders can minimize potential losses.

Types of Forex Algorithmic Trading Strategies

There are various types of strategies used in forex algorithmic trading. Let’s explore some common ones:

Trend-Following Strategies

Trend-following algorithms are among the simplest and most popular strategies in forex algo trading. They aim to capitalize on the momentum of a currency pair by entering a trade when a trend is confirmed and exiting when the trend weakens. These algorithms often rely on technical indicators such as moving averages, relative strength index (RSI), or Bollinger Bands.

Arbitrage Strategies

Arbitrage involves taking advantage of price discrepancies between different markets or instruments. In forex, arbitrage algorithms can exploit small price differences in currency pairs across different trading platforms. Although these price differences are often minimal and fleeting, algorithms can quickly execute trades to profit from them.

Market-Making Strategies

In market-making strategies, algorithms continuously buy and sell currencies, profiting from the bid-ask spread. These algorithms aim to provide liquidity to the market by ensuring that orders are always available to be filled. While market-making strategies are often employed by large institutions, individual traders can also implement them.

Mean Reversion Strategies

Mean reversion strategies operate on the assumption that the price of a currency pair will revert to its average or mean value over time. When the price moves significantly away from its historical average, the algorithm buys or sells with the expectation that it will return to its mean.

High-Frequency Trading (HFT)

High-frequency trading is a specialized form of algorithmic trading that involves executing a large number of trades at lightning speed. HFT algorithms rely on powerful computing systems and advanced technologies to exploit minute price inefficiencies in the forex market.

Advantages of Forex Algorithmic Trading

There are several reasons why traders are increasingly turning to algorithmic trading in the forex market:

Speed and Precision

One of the most significant advantages of algorithmic trading is its ability to execute trades faster than any human could. In forex trading, where currency prices can change in milliseconds, speed can mean the difference between profit and loss. Algorithms can process vast amounts of data and make decisions instantly, which is particularly important in a 24-hour market like forex.

Minimizing Human Emotion

Trading can be an emotional rollercoaster, with fear, greed, and excitement often clouding a trader’s judgment. Algorithmic trading eliminates these emotions by sticking to a predefined set of rules. This ensures consistency and reduces the likelihood of making impulsive decisions.

Backtesting

Before deploying a forex algorithm in live markets, traders can backtest their strategies using historical data. This allows them to assess the strategy’s effectiveness and make adjustments without risking real money.

Risk Management

Many forex algorithms come with built-in risk management tools, such as stop-loss and take-profit orders. These features protect traders from significant losses and ensure that trades are executed within their risk tolerance.

24/7 Trading

The forex market operates 24 hours a day, 5 days a week. With algorithmic trading, traders can take advantage of global market opportunities at any time, without having to monitor the markets constantly.

Challenges of Forex Algorithmic Trading

While forex algorithmic trading offers numerous benefits, it also comes with certain challenges:

Technical Knowledge

Developing a successful algorithmic trading system requires technical expertise in both programming and market analysis. Traders must understand how to code, use trading platforms, and develop effective strategies.

Market Risk

Like any other trading strategy, forex algorithmic trading carries inherent market risks. While algorithms can reduce human error, they are not immune to unforeseen market events or crashes.

Over-Optimization

When backtesting a strategy, there is a risk of over-optimizing the algorithm based on historical data. While a perfectly optimized algorithm may perform well in backtesting, it may fail to adapt to real-time market conditions.

How QuantL AI Can Help You Succeed

At QuantL AI, we understand the complexities of forex trading and the challenges traders face. That’s why we offer a range of automated trading solutions designed to simplify the trading process and help you achieve your financial goals.

Why Choose Our Automated Trading Solutions?

User-Friendly Platform: Our platform is designed with beginners in mind, offering an intuitive interface that makes trading easy and accessible.

Customizable Strategies: Our automated strategies can be tailored to match your risk tolerance and trading goals, whether you’re looking for short-term gains or long-term growth.

Real-Time Market Data: Stay informed with real-time market data and analysis, ensuring that you make the best possible trading decisions.

24/7 Support: Our customer support team is available around the clock to assist you with any questions or issues you may have.

Conclusion

Forex algorithmic trading opens up new possibilities for traders looking to harness the power of automation, speed, and precision in their currency trades. By understanding the basics, you can better navigate the evolving world of forex trading and improve your chances of success.

At QuantL AI, we are at the forefront of this technological revolution, offering automated trading solutions that eliminate human error and save you time. Whether you are a novice trader or an experienced professional, our platform is designed to enhance your trading experience and help you achieve your financial goals.

Ready to take your trading to the next level? Explore our automated trading solutions today and start your journey towards smarter, more efficient trading.

By incorporating automated strategies into your trading routine, you can stay ahead of the curve and maximize your potential for success. Happy trading!

For more information on how our automated trading strategies can benefit you, visit quantl.ai or get in touch with our team at [email protected]. We’re here to support you every step of the way!