In the world of modern finance, trading has evolved at breakneck speed, and one of the most revolutionary innovations is High-Frequency Trading (HFT).

HFT has garnered significant attention, both for its ability to make markets more efficient and for its controversial role in increasing market volatility. But what exactly is high-frequency trading? How does it work, and what kind of impact does it have on the markets?

In this blog, we’ll dive into the fundamentals of high-frequency trading, explore how it functions, and provide real-world examples that highlight its role in shaping today’s financial markets.

What is High-Frequency Trading (HFT)?

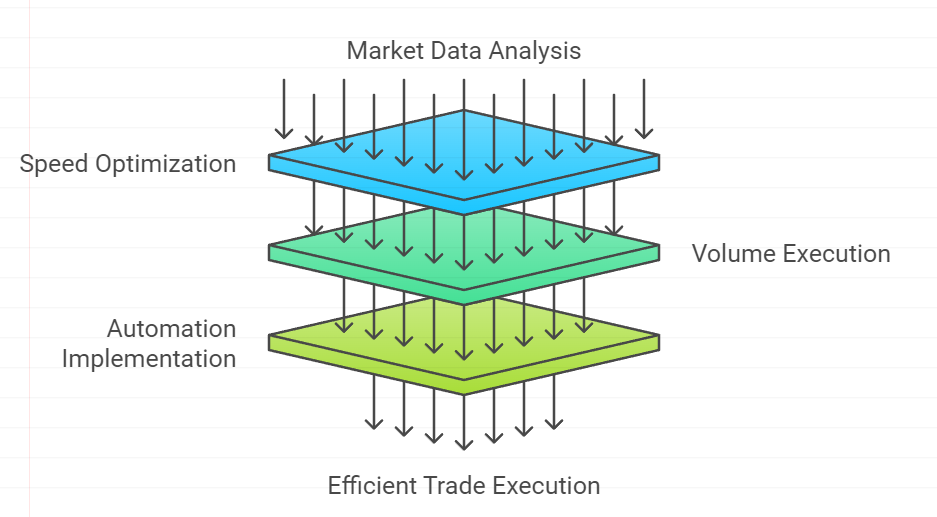

At its core, High-Frequency Trading (HFT) is a form of algorithmic trading that uses advanced computer algorithms to execute thousands—or even millions—of trades in fractions of a second. HFT is characterized by three primary features: speed, volume, and automation.

Speed: HFT strategies rely on lightning-fast data transmission and trade execution, often measured in microseconds or nanoseconds. Traders deploy HFT systems with the goal of capitalizing on tiny price discrepancies that exist only for a brief moment.

Volume: Due to the rapid-fire nature of HFT, these systems trade in incredibly high volumes. Rather than focusing on a few large trades, HFT algorithms execute thousands or millions of small trades.

Automation: Human decision-making can’t keep up with the speed required for HFT. Thus, these trades are entirely automated, with algorithms making decisions based on pre-set criteria and massive amounts of real-time data.

How Does High-Frequency Trading Work?

HFT is a sophisticated blend of algorithmic trading and cutting-edge technology. To understand how it works, let’s break down the key elements involved:

Algorithm Development: HFT strategies start with the creation of a trading algorithm, which is a set of rules or instructions programmed to make decisions in real-time. These algorithms are designed by highly skilled quantitative analysts (quants), who use statistical models and machine learning techniques to predict small price movements in the market.

Co-location: To reduce latency, HFT firms often place their servers as close as possible to the exchange’s servers. This practice, called co-location, ensures that their algorithms can receive and respond to market data faster than their competitors.

Order Execution: Once the algorithm detects a trading opportunity—such as a price discrepancy between two exchanges—it executes an order at lightning speed. The speed of execution is critical in HFT, as the window for exploiting these tiny market inefficiencies is often measured in microseconds.

Market Making: Many HFT strategies revolve around market making, where firms place buy and sell orders simultaneously, profiting from the small spread between the bid and ask prices. By rapidly entering and exiting these trades, HFT firms can accumulate small profits on thousands of trades throughout the day.

Arbitrage: Another common HFT strategy is arbitrage, where firms exploit price differences for the same asset on different exchanges or in different markets. For example, if stock XYZ is trading at $50.10 on one exchange and $50.12 on another, an HFT algorithm might simultaneously buy on the cheaper exchange and sell on the more expensive one, locking in a small profit.

Statistical Arbitrage: This involves using complex mathematical models to identify price patterns and correlations between different assets. When these assets deviate from their expected relationship, the algorithm executes trades to capitalize on the price divergence, anticipating that the prices will eventually revert to their historical correlation.

Advantages of High-Frequency Trading

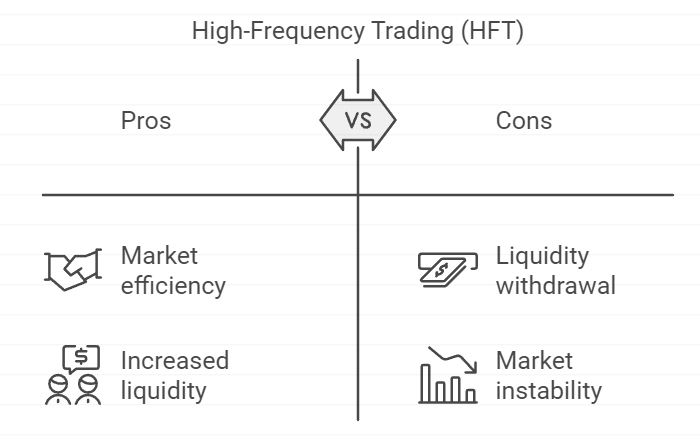

High-frequency trading offers several key benefits to the financial markets, including:

Increased Market Liquidity

HFT algorithms constantly place buy and sell orders, which enhances liquidity by ensuring that there is always someone willing to trade. This increased liquidity helps narrow bid-ask spreads, reducing the cost of trading for all market participants.

Efficient Price Discovery

Because HFT algorithms process vast amounts of data in real-time, they contribute to more accurate and efficient price discovery. The rapid-fire nature of HFT ensures that prices quickly reflect all available information, helping markets remain competitive and transparent.

Reduced Transaction Costs

With millions of trades being executed in microseconds, HFT can help lower transaction costs. By trading large volumes of small orders, HFT reduces the market impact of each individual trade, keeping costs low for the firm—and, in many cases, for the overall market.

Risks and Criticisms of High-Frequency Trading

While HFT offers clear benefits, it’s not without its risks and controversies. Several critics argue that HFT can exacerbate market volatility and contribute to flash crashes. Here are some of the major criticisms:

Market Manipulation

Some HFT strategies have been accused of market manipulation. For instance, spoofing involves placing large fake orders to create the illusion of supply or demand, only to cancel those orders before they’re executed. This practice can mislead other traders and disrupt the market.

Flash Crashes

HFT’s speed can contribute to sudden, sharp price drops known as flash crashes. One of the most infamous examples is the Flash Crash of 2010, when the Dow Jones Industrial Average plummeted nearly 1,000 points within minutes, only to recover almost as quickly. Many analysts believe HFT played a significant role in the crash by rapidly withdrawing liquidity during the downturn.

Unfair Advantage

HFT firms invest heavily in infrastructure and co-location to gain a speed advantage. This has led to concerns that HFT creates an uneven playing field, where retail traders and smaller institutions can’t compete due to the lack of access to similar resources and technology.

Market Volatility

HFT’s rapid execution of trades can amplify price swings, especially during periods of uncertainty. Critics argue that HFT can turn minor price fluctuations into larger movements, increasing overall market volatility.

A Real-World Example of HFT in Action

One notable example of HFT at work occurred during the Flash Crash of May 6, 2010. On that day, markets experienced an unprecedented plunge when the Dow Jones dropped nearly 1,000 points within minutes.

While the exact cause remains debated, many analysts point to high-frequency trading as a contributing factor.

During the flash crash, HFT firms initially provided liquidity to the market by placing orders.

However, as selling pressure mounted, many of these firms began pulling their bids, causing a rapid drop in liquidity. With fewer buyers, the market experienced a sharp decline, triggering stop-loss orders and automatic trading systems, which further accelerated the sell-off.

While the market eventually recovered most of its losses, the event highlighted both the potential benefits and dangers of HFT. On one hand, HFT contributed to market efficiency by tightening spreads and adding liquidity in normal conditions.

On the other hand, the withdrawal of liquidity during the crisis exacerbated the crash.

How QuantL AI Can Help You Succeed

At QuantL AI, we understand that navigating the complexities of algorithmic trading can be daunting.

That’s why we offer a range of automated trading solutions designed to help both beginners and experienced traders succeed in the fast-paced world of high-frequency trading.

Why Choose QuantL AI’s Automated Trading Solutions?

User-Friendly Platform: Our platform is designed with ease of use in mind, making it accessible for traders at all experience levels.

Customizable Strategies: Tailor your automated trading strategies to suit your risk tolerance and financial goals, whether you’re looking for short-term gains or long-term growth.

Real-Time Market Data: Stay ahead of the game with real-time market data and analysis, ensuring you make well-informed trading decisions.

24/7 Support: Our dedicated customer support team is available around the clock to answer any questions or address any concerns.

Conclusion

High-frequency trading has revolutionized the way financial markets operate, offering both opportunities and challenges to traders and investors.

While HFT provides benefits like enhanced liquidity and efficient price discovery, it also comes with risks, such as market manipulation and increased volatility.

As the financial landscape continues to evolve, it’s essential to understand the role of HFT and how it affects both large institutions and retail investors.

At QuantL AI, we are at the forefront of this technological revolution, offering automated trading solutions that eliminate human error and save you time.

Whether you are a novice trader or an experienced professional, our platform is designed to enhance your trading experience and help you achieve your financial goals.

Ready to take your trading to the next level? Explore our automated trading solutions today and start your journey towards smarter, more efficient trading.

By incorporating automated strategies into your trading routine, you can stay ahead of the curve and maximize your potential for success. Happy trading!

For more information on how our automated trading strategies can benefit you, visit quantl.ai or get in touch with our team at [email protected]. We’re here to support you every step of the way!