The foreign exchange market, commonly known as Forex or FX, is the largest and most liquid financial market in the world.

With over $6 trillion traded daily, Forex surpasses all other financial markets combined. Unlike stock markets, Forex is a decentralized, over the counter (OTC) market where currencies are traded between global participants, including governments, banks, corporations, and individual traders.

This 24-hour market allows for round-the-clock trading across various time zones, making it an attractive option for those looking to capitalize on global economic movements.

The Basics of Forex Trading

At its core, Forex trading is the act of buying one currency while simultaneously selling another. Every trade in Forex is done through a currency pair.

For example, if you trade EUR/USD, you are trading euros against U.S. dollars. The first currency in the pair (EUR) is the base currency, and the second one (USD) is the quote currency.

When the price of the currency pair increases, it means the base currency is strengthening relative to the quote currency. Conversely, when the price decreases, the base currency is weakening against the quote currency.

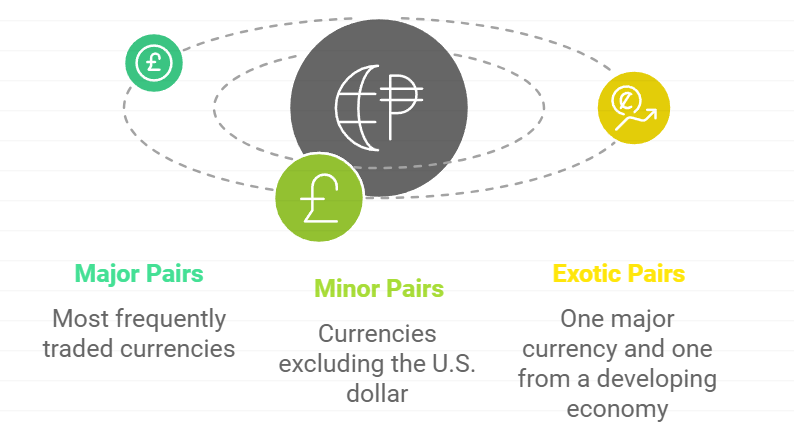

Commonly Traded Currency Pairs

There are three types of currency pairs in the Forex market: majors, minors, and exotics. Major currency pairs consist of the most frequently traded currencies, including:

EUR/USD: Euro / U.S. Dollar

GBP/USD: British Pound / U.S. Dollar

USD/JPY: U.S. Dollar / Japanese Yen

AUD/USD: Australian Dollar / U.S. Dollar

Minor currency pairs involve currencies like the Australian dollar, Canadian dollar, and New Zealand dollar but exclude the U.S. dollar. Exotic pairs involve one major currency and one currency from a smaller or developing economy, such as the South African rand (ZAR) or Turkish lira (TRY).

How Forex Trading Works

Bid and Ask Prices

In Forex trading, each currency pair is quoted with two prices: the bid price and the ask price. The bid price is the price at which you can sell the base currency, while the ask price is the price at which you can buy the base currency. The difference between these two prices is known as the spread. Forex brokers make money by charging this spread.

Leverage

One of the defining characteristics of Forex trading is leverage. Leverage allows traders to control large positions with a relatively small amount of capital.

For example, with a leverage ratio of 100:1, a trader with just $1,000 can control a position worth $100,000. While leverage can amplify gains, it can also magnify losses, making it essential for traders to understand the risks involved.

Pips and Lot Sizes

In Forex, the smallest price movement is referred to as a pip (percentage in point). For most major currency pairs, a pip is the fourth decimal place, or 0.0001. The value of a pip depends on the size of the trade, which is measured in lots. A standard lot is 100,000 units of currency, a mini lot is 10,000 units, and a micro lot is 1,000 units.

For instance, if EUR/USD moves from 1.1000 to 1.1001, that is a one-pip movement. If you were trading a standard lot, each pip would be worth $10.

Why Do People Trade Forex?

Profit Opportunities

Many traders are attracted to Forex due to the profit potential. Since currency values are constantly fluctuating due to global economic, political, and market forces, there are numerous opportunities to capitalize on price movements.

Hedging

Multinational corporations and governments use Forex trading to hedge against currency risk. For example, a U.S. company expecting payment in euros might use the Forex market to lock in a favorable exchange rate, protecting itself from a potential fall in the value of the euro.

Diversification

Investors often use Forex as a tool to diversify their portfolios. Since currency movements are influenced by different factors than stocks or bonds, adding Forex can reduce overall risk.

The Role of Central Banks in Forex

Central banks play a crucial role in the Forex market. Through monetary policy, central banks like the Federal Reserve (Fed) or the European Central Bank (ECB) control interest rates and influence the value of their respective currencies.

For instance, when a central bank raises interest rates, it makes that country’s currency more attractive to investors, leading to an increase in value. Conversely, lower interest rates tend to weaken a currency as investors seek higher returns elsewhere.

Central banks also engage in foreign exchange interventions to stabilize or influence their currency. For example, they may buy their own currency to strengthen it or sell it to weaken its value in global markets.

Popular Forex Trading Strategies

Forex traders employ various strategies to maximize returns and manage risk. Here are some of the most popular ones:

Scalping

Scalping is a strategy where traders make numerous small trades throughout the day, aiming to capture tiny price movements. Scalpers usually hold positions for a few seconds or minutes and rely on high trading volumes to achieve significant profits.

Day Trading

Day trading involves opening and closing trades within the same day, with the goal of profiting from short-term market fluctuations. Day traders typically rely on technical analysis and chart patterns to make quick decisions.

Swing Trading

Swing trading is a longer-term strategy compared to day trading, where traders hold positions for several days or weeks. The aim is to capture medium-term market movements by using both technical and fundamental analysis.

Position Trading

Position trading involves holding positions for months or even years, aiming to profit from long-term trends. Position traders focus more on fundamental analysis and macroeconomic factors such as GDP growth, inflation, and interest rates.

Risks of Forex Trading

While the Forex market offers attractive opportunities, it also comes with risks that every trader should be aware of.

Volatility

Forex markets can be extremely volatile, especially during times of economic uncertainty or geopolitical events. While volatility creates profit opportunities, it also increases the potential for significant losses.

Leverage Risk

While leverage can amplify gains, it also magnifies losses. For example, a small price movement against a highly leveraged position can wipe out a trader’s account. Traders must exercise caution and use risk management techniques, such as setting stop-loss orders.

Market Risk

The decentralized nature of the Forex market means that prices are influenced by a wide range of factors, including economic reports, political events, and central bank policies. This makes predicting currency movements highly challenging.

Example of a Forex Trade

Let’s say you believe the euro will strengthen against the U.S. dollar. You decide to buy EUR/USD at 1.2000.

This means you’re buying euros and selling U.S. dollars. If the price rises to 1.2100, you can sell the pair for a profit.

For example, if you were trading one standard lot (100,000 units), each pip would be worth $10. A movement of 100 pips would yield a profit of $1,000.

How QuantL AI Can Help You Succeed

At QuantL AI, we are committed to helping traders, from beginners to experienced investors, succeed in the Forex market. We offer a range of automated trading solutions that simplify the process, allowing you to focus on your financial goals.

Why Choose Our Automated Trading Solutions?

User-Friendly Platform: Our platform is designed with simplicity in mind, making it easy for both beginners and experienced traders to navigate.

Customizable Strategies: You can tailor our automated strategies to align with your specific risk tolerance and trading goals, whether you’re seeking short-term gains or long-term growth.

Real-Time Market Data: Stay informed with real-time data and insights to make well-informed trading decisions.

24/7 Support: Our customer support team is available around the clock to assist you with any questions or concerns.

Conclusion

Forex trading is a vast and dynamic market offering opportunities for profit, risk management, and portfolio diversification. However, it’s essential to understand the mechanics of how the market works, develop sound strategies, and manage risk carefully. Whether you’re a seasoned trader or just getting started, the right tools and knowledge will help you navigate this exciting market.

At QuantL AI, we are at the forefront of this technological revolution, offering automated trading solutions that eliminate human error and save you time. Whether you are a novice trader or an experienced professional, our platform is designed to enhance your trading experience and help you achieve your financial goals.

Ready to take your trading to the next level? Explore our automated trading solutions today and start your journey towards smarter, more efficient trading.

By incorporating automated strategies into your trading routine, you can stay ahead of the curve and maximize your potential for success. Happy trading!

Feel free to contact us for more information or to schedule a demo of our automated trading platform. Let’s revolutionize your trading experience together!