When it comes to stock trading, swing trading is a popular strategy that appeals to both beginners and seasoned investors. It combines the excitement of short-term trades with the potential for significant profits.

Swing trading allows traders to capitalize on short- to medium-term price fluctuations while maintaining a flexible schedule, making it an ideal approach for those who may not be able to monitor the market constantly throughout the day.

In this blog, we’ll explore how to swing trade stocks, dive into strategies and tips for success, and understand the risks involved. By the end, you should have a clear understanding of whether swing trading aligns with your investment style and how to get started with confidence.

What is Swing Trading?

It is a type of trading that seeks to capture gains in a stock (or any financial instrument) over a few days to several weeks. Unlike day traders who close their positions before the market closes each day, swing traders hold positions longer, but not long enough to be considered long-term investors.

The main goal of swing trading is to take advantage of short- to medium-term price movements, usually by using technical analysis to identify patterns and trends.

Swing traders aim to “ride the wave” of a stock’s movement—buying at the low points (support levels) and selling at the high points (resistance levels).

This strategy is popular because it strikes a balance between long-term investing and fast-paced day trading, making it a versatile option for many traders.

Key Concepts in Swing Trading

Before diving into swing trading strategies, it’s essential to understand a few key concepts that will guide your trading decisions.

Trend: This refers to the general direction in which a stock is moving. Trends can be upward (bullish), downward (bearish), or sideways (neutral). Swing traders often look for stocks in clear trends to increase their chances of success.

Support and Resistance: Support is the price level where a stock tends to find buying interest, preventing the price from falling further. Resistance, on the other hand, is the price level where selling interest prevents the price from rising further. Swing traders look to buy near support and sell near resistance.

Technical Analysis: Unlike fundamental analysis, which focuses on a company’s financial health, technical analysis involves studying charts and price patterns to predict future movements. Key technical indicators used in swing trading include moving averages, relative strength index (RSI), and stochastic oscillators.

Risk Management: Successful swing traders know how to manage their risk. This often involves using stop-loss orders, which automatically close a position if the stock price moves against you by a certain percentage.

How to Swing Trade Stocks: A Step-by-Step Guide

Step 1: Choose the Right Stocks

One of the most important steps in swing trading is selecting the right stocks. Not all stocks are suitable for swing trading; you want to choose stocks that are volatile enough to experience price fluctuations but stable enough to avoid extreme, unpredictable changes. Some key characteristics to look for include:

Liquidity: Stocks that are actively traded and have high trading volumes are easier to buy and sell without significant price changes.

Volatility: Look for stocks that have sufficient price movements to generate meaningful profits but aren’t prone to erratic behavior.

Strong Trends: Stocks that are trending upwards or downwards offer the best swing trading opportunities.

Step 2: Conduct Technical Analysis

Swing trading relies heavily on technical analysis to make informed trading decisions. Here’s a quick overview of the key tools and indicators:

Moving Averages (MA): These smooth out price data to identify trends. Swing traders often use a combination of short-term (e.g., 50-day) and long-term (e.g., 200-day) moving averages to spot buying and selling opportunities. A “golden cross” (short MA crossing above long MA) signals a potential buying opportunity, while a “death cross” (short MA crossing below long MA) signals a selling opportunity.

Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. RSI values above 70 indicate that a stock is overbought (potential sell signal), while values below 30 indicate that a stock is oversold (potential buy signal).

MACD (Moving Average Convergence Divergence): MACD is another momentum indicator that shows the relationship between two moving averages of a stock’s price. It can help swing traders spot potential buy and sell signals by analyzing when the MACD line crosses above or below the signal line.

Step 3: Set Entry and Exit Points

Entry and exit points are crucial in swing trading. You need to know when to buy and, more importantly, when to sell. Here are some common strategies for setting these points:

Buying at Support: Entering a position when a stock’s price nears a support level can be a good way to minimize risk.

Selling at Resistance: Similarly, selling when a stock reaches its resistance level can help lock in profits.

Use Stop-Loss Orders: Place a stop-loss order slightly below your entry price to limit losses if the trade goes against you. This is one of the most important aspects of risk management.

Step 4: Monitor Your Trades

Once your trade is active, it’s essential to monitor it regularly. While swing trading doesn’t require the constant attention of day trading, you still need to keep an eye on the market to ensure your trade stays on track. Many swing traders use trailing stop orders to lock in profits as the stock moves in their favor.

Step 5: Exit the Trade

Knowing when to exit a trade is just as important as knowing when to enter. Some key indicators that signal it’s time to exit include:

The Stock Hits Resistance: If a stock has reached its resistance level and shows signs of reversing, it might be time to sell.

A Stop-Loss is Triggered: If your stop-loss order is triggered, it’s best to stick to your plan and exit the trade.

A Trend Reversal Occurs: If the overall trend of the stock changes direction, it’s often a good idea to exit the trade to avoid potential losses.

Risks Involved in Swing Trading

Swing trading, like any form of trading, carries risks. These include:

Market Risk: The stock market is unpredictable, and even the best technical analysis can’t always predict sudden price movements due to news events or market sentiment shifts.

Emotional Risk: It’s easy to let emotions get in the way of trading decisions. Fear of missing out (FOMO) or holding onto a losing position in the hopes of recovery can lead to unnecessary losses.

Overtrading: Swing traders need to avoid the temptation to trade too often. Overtrading can lead to higher transaction fees and reduce your overall profitability.

Swing Trading vs. Day Trading

While swing trading and day trading may seem similar, they have significant differences:

Time Frame: Day traders open and close positions within a single trading day, while swing traders hold positions for days or weeks.

Effort: Day trading requires constant attention to the market, while swing trading can be more flexible with less frequent monitoring.

Risk: Day trading tends to involve higher risk because of the fast-paced nature of the trades, while swing trading offers more time to react to price movements.

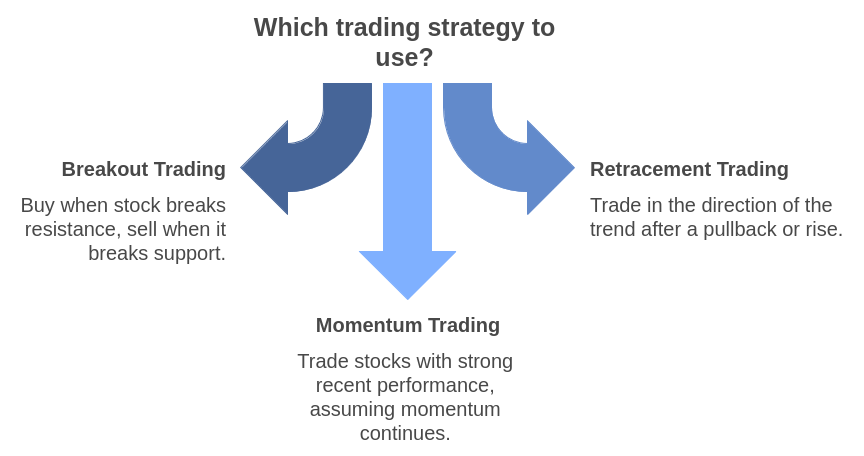

Swing Trading Strategies

Here are a few popular swing trading strategies to consider:

Breakout Trading: This strategy involves buying a stock as it breaks through a resistance level or selling as it breaks through a support level.

Retracement Trading: Retracement traders look for stocks that have pulled back from a recent high (in an uptrend) or have risen from a recent low (in a downtrend) and trade in the direction of the overall trend.

Momentum Trading: Swing traders using momentum look for stocks showing strong recent performance, assuming that the momentum will continue for a few days or weeks.

How QuantL AI Can Help You Succeed

At QuantL AI, we are dedicated to helping beginners succeed in trading. We offer a range of automated trading solutions designed to simplify the trading process and help you achieve your financial goals.

Why Choose Our Automated Trading Solutions?

User-Friendly Platform: Our platform is designed with beginners in mind, offering an intuitive interface that makes trading easy and accessible.

Customizable Strategies: Our automated strategies can be tailored to match your risk tolerance and trading goals, whether you’re looking for short-term gains or long-term growth.

Real-Time Market Data: Stay informed with real-time market data and analysis, ensuring that you make the best possible trading decisions.

24/7 Support: Our customer support team is available around the clock to assist you with any questions or issues you may have.

Starting your trading journey can be both exciting and challenging, but with the right tools and knowledge, you can build a solid foundation for success. Let us help you take the first step toward achieving your trading goals. Ready to get started? Visit our website or contact us today to learn more about our automated trading solutions.

Conclusion

Swing trading offers a versatile and potentially profitable way to trade stocks, allowing traders to capture short- to medium-term price movements.

With the right strategies and tools, swing trading can become an effective part of your overall trading plan. As always, it’s crucial to practice proper risk management and make informed decisions based on technical analysis and market trends.

At QuantL AI, we are at the forefront of this technological revolution, offering automated trading solutions that eliminate human error and save you time. Whether you are a novice trader or an experienced professional, our platform is designed to enhance your trading experience and help you achieve your financial goals.

Ready to take your trading to the next level? Explore our automated trading solutions today and start your journey towards smarter, more efficient trading.

By incorporating automated strategies into your trading routine, you can stay ahead of the curve and maximize your potential for success. Happy trading!

Feel free to contact us at [Contact Information] for more information or to schedule a demo of our automated trading platform. Let’s revolutionize your trading experience together!