In the fast-paced world of financial markets, algorithmic trading has rapidly become a dominant force. What was once the domain of a few tech-savvy institutional traders has now been embraced by retail investors and professionals alike, eager to capitalize on the efficiency and precision that algorithms offer. But what exactly is algorithmic trading, and how can you tap into its potential? Let’s take a deep dive into the fundamentals of algorithmic trading, explore different strategies, and guide you from the basics to more advanced methods that could revolutionize your trading experience.

What is Algorithmic Trading?

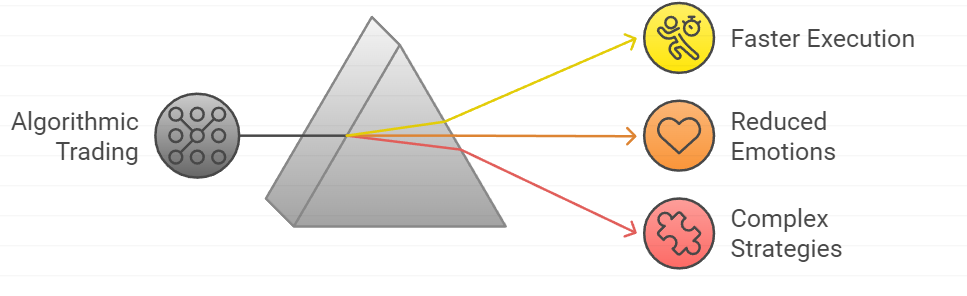

Algorithmic trading (or algo trading) is the use of computer programs to automate the execution of trades based on predefined rules, such as price movements, technical indicators, or market conditions. These algorithms analyze massive amounts of data in milliseconds, making trades at speeds no human could replicate. The advantages are clear: faster execution, reduced emotional decision-making, and the ability to trade complex strategies.

Think of it as setting up a system to do the heavy lifting for you—once the parameters are in place, the algorithm runs 24/7, making real-time trading decisions.

Key Features:

Speed and Efficiency: Algorithms react to market conditions in a fraction of a second.

Data-Driven: Decisions are based purely on data, removing emotional bias from the equation.

Back testing: Traders can test their strategies against historical data before putting real money on the line.

Consistency: Algorithms follow the plan exactly as designed, never wavering due to fear or greed.

The Basics of Algorithmic Trading

For those new to the world of algorithmic trading, here are some beginner-friendly strategies to help you understand the fundamentals:

Mean Reversion Strategy

The mean reversion strategy assumes that asset prices, which can deviate from their long-term average, will eventually revert to that average. When prices are lower than their mean, you buy; when they’re higher, you sell. It’s a simple approach often used by beginners to profit from short-term fluctuations.

Example: If stock XYZ is trading well below its 50-day moving average, an algorithm might signal a buy, expecting the price to return to that average.

Trend Following Strategy

This is perhaps one of the most popular algo strategies. Trend following aims to capitalize on the momentum of an asset. If an asset is trending upwards, the algorithm will buy and hold; if it’s trending downwards, it will sell or short. The idea is to follow the herd—but faster and smarter.

Example: If gold has been rising for several weeks, the algorithm will buy, riding the momentum upward.

Arbitrage

Arbitrage opportunities arise when there’s a price discrepancy between two markets. With lightning-fast algorithms, traders can buy low in one market and sell high in another almost simultaneously, capturing profit from the price differential.

Example: If Bitcoin is trading at $30,000 on one exchange and $30,100 on another, an arbitrage algorithm can buy at $30,000 and immediately sell at $30,100 to pocket the difference..

Intermediate Strategies: Stepping Up Your Game

Once you’re comfortable with the basics, it’s time to explore more nuanced strategies that involve deeper analysis and greater sophistication.

Statistical Arbitrage

This strategy involves identifying mispriced securities using statistical models and capitalizing on their expected mean reversion. Traders often pair similar stocks, buying the underperformer and shorting the outperformer.

Example: If two oil companies’ stocks usually move together but one deviates, statistical arbitrage bets that the prices will realign.

Market Making

In market-making strategies, traders profit from the difference between the bid and ask prices. Algorithms continually place buy and sell orders to profit from the spread, providing liquidity to the market.

Example: A market-making algo might buy a stock at $100.50 and sell it at $100.60, profiting from the $0.10 difference.

Pairs Trading

Pairs trading involves simultaneously buying and selling two related securities when they diverge from their historical correlation. When one security outperforms the other, the strategy bets that the relationship will revert to the mean.

Example: If ExxonMobil’s stock rises sharply while Chevron’s stagnates, pairs trading might short ExxonMobil and buy Chevron, betting that the price gap will close.

Advanced Algorithmic Strategies: Harnessing Technology

The more advanced the strategy, the more it relies on cutting-edge technology and data analysis. Let’s explore some of the most innovative approaches in algorithmic trading.

High-Frequency Trading (HFT)

HFT strategies execute thousands of trades per second, taking advantage of fleeting market inefficiencies. These algorithms require top-tier infrastructure, such as super-fast internet connections and powerful servers, to succeed.

sentiment.

Example: An HFT strategy might capitalize on minute price differences between exchanges, executing trades faster than any human could detect the discrepancy.

Machine Learning Algorithms

The rise of artificial intelligence has taken algorithmic trading to new heights. Machine learning algorithms analyze massive datasets to detect patterns and adjust their trading strategies accordingly. Over time, these algorithms “learn” from the data, becoming more effective at predicting price movements.

Example: A machine learning algorithm might track the historical performance of a stock and recognize patterns that signal when it’s about to break out or decline, making data-driven predictions.

Sentiment Analysis

This approach scans news outlets, social media, and financial reports to gauge the overall sentiment surrounding a stock or market. The algorithm uses this information to predict future price movements based on positive or negative sentiment.

Example: A sudden flood of negative tweets about a company could trigger the algorithm to short the stock before the market reacts to the bad news.

Risks and Challenges of Algorithmic Trading

While algorithmic trading offers numerous benefits, it’s not without its risks. Algorithms are only as good as the data and logic they’re built on, and even the most well-thought-out strategies can falter in unpredictable markets.

Market Risk

Algorithms can’t predict black swan events or drastic market shifts. In highly volatile environments, they might make trades based on outdated data or assumptions, leading to significant losses.

Technical Failures

Algorithms rely on technical infrastructure, and any disruption—such as a server crash, network lag, or data feed issues—can result in missed opportunities or incorrect trades.

Overfitting

Overfitting occurs when an algorithm is too closely tailored to historical data, making it less effective in real-time conditions. A strategy that worked well in the past may not adapt to future market trends.

QuantL AI's Automated Trading Solutions

At QuantL AI, we’re passionate about helping traders of all experience levels achieve success in the world of algorithmic trading. Whether you’re a beginner eager to explore basic strategies or an experienced trader looking to refine advanced methods, we’ve got the tools you need.

Why Choose QuantL AI’s Automated Trading Solutions?

User-Friendly Platform: We’ve designed our platform with ease of use in mind, so traders at all levels can get started quickly and confidently.

Customizable Strategies: Tailor your automated strategies to match your risk tolerance and financial goals.

Real-Time Market Data: Stay ahead of the curve with the latest data and insights that keep you informed.

24/7 Support: Our customer support team is always available to help with any questions or issues.

Conclusion

Algorithmic trading offers endless possibilities for those willing to dive in and explore. From simple, beginner-friendly strategies to advanced, machine-learning-driven methods, the key to success lies in your ability to adapt, stay informed, and leverage the right tools.

At QuantL AI, we are at the forefront of this technological revolution, offering automated trading solutions that eliminate human error and save you time. Whether you are a novice trader or an experienced professional, our platform is designed to enhance your trading experience and help you achieve your financial goals.

Ready to take your trading to the next level? Explore our automated trading solutions today and start your journey towards smarter, more efficient trading.

By incorporating automated strategies into your trading routine, you can stay ahead of the curve and maximize your potential for success. Happy trading!

Feel free to contact us at [Contact Information] for more information or to schedule a demo of our automated trading platform. Let’s revolutionize your trading experience together!